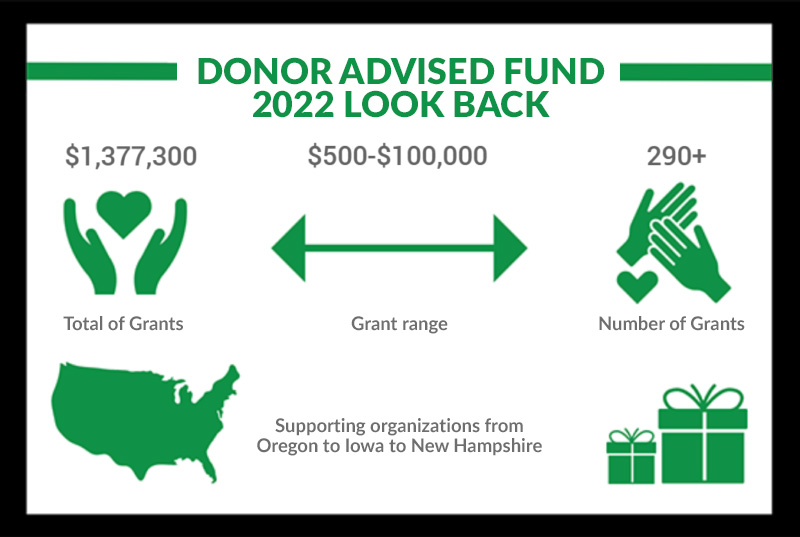

A Donor Advised Fund functions as a conduit. You make your contribution and claim your tax deduction now, then distribute money out to specific nonprofits over years or decades while your charitable dollars are invested and growing tax free. These funds, established through the Community Foundation, allow donors and their families to participate in the research, selection and awarding of grant dollars. Donors are free to give to any charitable cause, local or not, through a Donor Advised Fund.

A Donor Advised Fund can effectively function as a family foundation while offering much of the flexibility and appeal of a private foundation - without many of the regulations, requirements and overhead expenses. Donor Advised Funds are among the fastest growing charitable vehicles in personal philanthropy.

Is a Donor Advised Fund the right vehicle? Is a private foundation the right vehicle? There is no simple answer. Each tool offers its own advantages and disadvantages.

View this chart to learn more about the differences between a Donor Advised Fund and a private foundation. Donor advised funds have exploded in popularity because:

- Support charities you love now or over time

- Grow your donation tax-free

- Get just one tax receipt

- Donate cash, stocks, real estate, and more

- Give anonymously, if you wish

Whether there are causes that you are passionate about and want to support or you want to learn more about your giving options, a Donor Advised Fund can be the perfect solution to local, national and even global giving. A minimum donation of $10,000 can get you started.

To learn more, please contact Jackie Hanton, Vice President at 810-984-4761 or jackie@stclairfoundation.org.